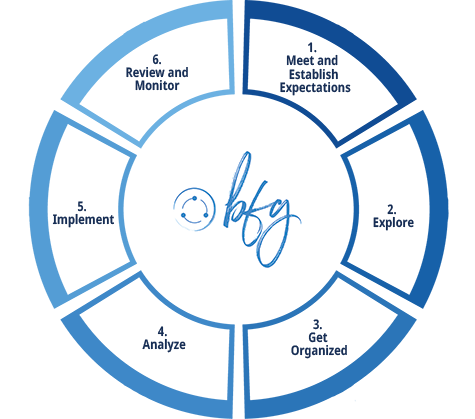

Our Process

We recognize that everyone’s financial situation is different and such as life, changes rapidly. A sound financial strategy is customized and adapts with the progression of life. To address this for our clients, we follow a six-step process to help ensure they stay and remain on course toward achieving their goals.

1. Meet and Establish Expectations

Our Process begins with gettng to know each other and establishing expectations.

2. Explore

A more in-depth conversation revolving around your goals and priorities, both personal and financial.

What do you value most?

How do you imagine your future? And how does it differ from today?

3. Get Organized

Gather all the necessary documents and information.

4. Analyze

Evaluate your current financial position and existing assets while assessing your current risk exposure to develop an efficient strategy.

5. Implement

Meet to present your overall financial picture, explain our approach and implementation plan for pursuing your goals.

6. Review and Monitor

Ongoing reviews may be quarterly, semi-annually, or annually to address the numerous variables that can affect a financial strategy.

Financial plan recommendations can be implemented with the advisor of your choosing. Implementation of specific products or services may result in commissions or fees outside of the financial plan fee. Periodic reviews of your financial plan may require a new planning agreement and result in additional fees.